Are OEMs Losing Aftermarket Revenue Once the Equipment Is Sold?

Absolutely – and the loss is significant.

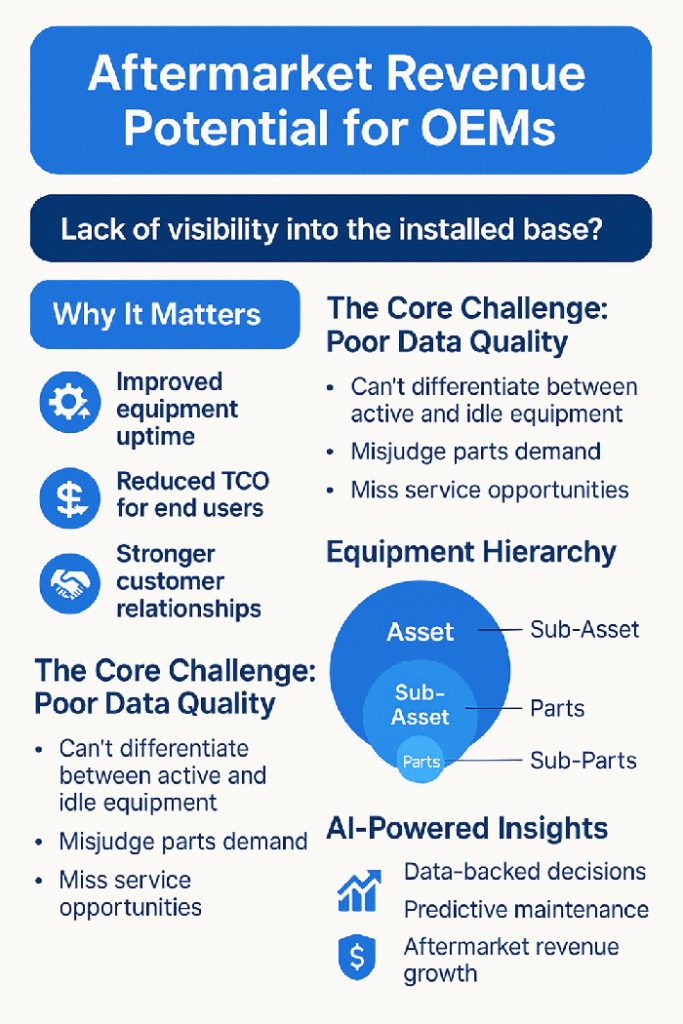

Many equipment manufacturers struggle to fully capitalize on the aftermarket revenue potential that exists after the initial sale. Once the equipment is delivered and installed, the customer relationship often becomes passive, resulting in missed opportunities for spare parts, maintenance, upgrades, and long-term services.

A major roadblock? Lack of visibility into the equipment’s lifecycle.

Why Installed Base Visibility Matters

A clear understanding of your installed base delivers tangible, measurable benefits:

- Improved Equipment Uptime

- Reduced Total Cost of Ownership (TCO) for End Users

- Stronger, Stickier Customer Relationships

By tracking and analyzing where and how equipment is being used, OEMs can move from reactive service models to proactive and predictive engagement. This not only boosts customer satisfaction but also opens new aftermarket revenue streams.

The Core Challenge: Poor Data Quality

Many OEMs are aware of the potential but fail to tap into it due to poor data quality. Without accurate and validated installed base data:

- You can’t differentiate between active, idle, or decommissioned equipment.

- You misjudge parts demand, leading to stockouts or overstocking.

- You miss service opportunities due to a lack of visibility.

For example, a material handling equipment manufacturer needs to clearly know which assets are still operational to anticipate service and spare parts demand. This is impossible without accurate data feeds and intelligent validation mechanisms.

The Power of Taxonomy: Understand the Equipment Hierarchy

Another key enabler of aftermarket success is a well-defined equipment taxonomy:

- Asset → Sub-Asset → Parts → Sub-Parts

Understanding this hierarchy:

- Enables optimized inventory and supply chain management.

- Ensures rapid and accurate response to service requests.

- Improves the precision of customer interactions based on the asset lifecycle.

Without this taxonomy, aftermarket operations remain fragmented and inefficient.

How AI-Powered Insights Help

Modern OEMs are turning to AI-driven tools to make sense of their installed base and unlock new revenue streams.

AI-Powered Reporting Enables:

- Data-backed decision-making

- Predictive maintenance and parts replacement.

- Optimized parts/service logistics and inventory.

- Revenue growth from aftermarket services.

By leveraging machine learning and advanced analytics, OEMs can predict failures, identify upsell opportunities, and stay continuously engaged with customers.

In Summary

Capital equipment sales may bring the first wave of revenue, but the aftermarket is where long-term profitability lies.

To win in today’s competitive landscape, OEMs must:

- Prioritize installed base visibility

- Invest in data quality and taxonomy

- Leverage AI and analytics for smarter decisions

Those who do will not only drive revenue growth but also build more resilient customer relationships and operational agility.